January 31st 2024

Grains and Markets

National Holiday: Monday and Tuesday February 12th and 13th, 2024 (Carnival)

Mv EN MAY – Collision at Zarate – Traffic Upriver interrupted:

As reported previously, the mv EN MAY remains at Zarate (Km 106) on the River Paraná de las Palmas inserted on the dolphin of the bridge that spans the River at this position.

CoastGuard surveys have been completed and one tug remains standby.

Traffic through the area is interrupted since Sunday 28th 21:30 hours.

It is reported that salvage and rescue have not yet been organized or agreed by the Owners of the vessel.

In the meantime loaded vessels that were due to navigate the area on drafts in the order of 10.50 meters are accumulating at the roads upriver of the accident and CoastGuard Traffic Control are being stringent granting vessels transit through the Martin Garcia/River Parana Guazú, subject to space at the load port.

Grains and Markets:

China will now allow Argentine wheat to be imported.

South Korea’s FLC has purchased 65,000 tons of maize from CHS, April-May dates, optional origin US/ECSA/Safr. Also South Korea, but KFA in this case bought 65,000 tons of maize for late April from Mitsui, origin US or ECSA. Venezuela is in the market for Supramax of soya bean meal in April. Iran is to come out in the market for 1-2-3 Panamaxes of soya bean meal February/March. Algeria’s tender for 240,000 tons of maize was called off.

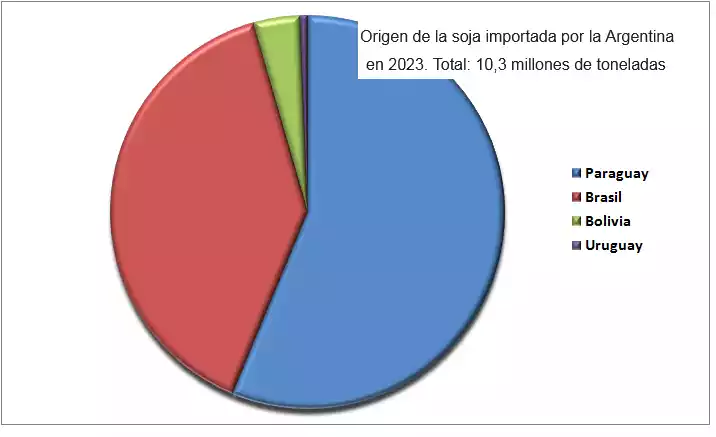

Soya bean imports to Argentina – 2023:

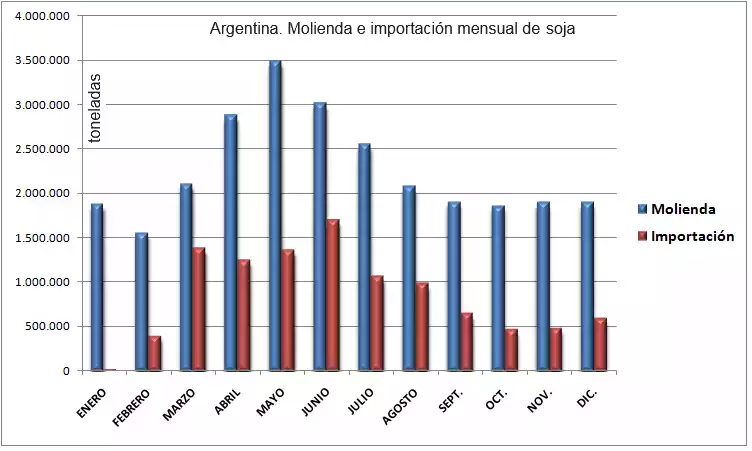

Import of soya beans to Argentina during 2023 amounted to 10,300,000 tons. On the graph below the monthly crushing during 2023 is shown in the red column and the volume imported in blue.

It must be considered that 2023 was the year when the three year drought struck hardest.

Soya bean crushing capacity in Argentina exceeds a normal healthy soya bean harvest and imports of 4 to 5,000,000 tons from Paraguay are customary to feed the factories Upriver.

During 2023 Paraguay also was affected by the drought and almost their entire production was processed in Argentina.

As can be seen on the chart the shortfall was compensated by Brazilian beans imported principally on ocean going vessels from North Brazil.

Bunkers at Zona Comun:

Bunker prices at Zona Comun have increased from USD 587 per ton of VLSFO on January 17th to USD 645 per ton on January 29th.

Market sources say that there have been two factors that affect this increase in price:

- Increased demand at Zona Comun due to a return of the usual volume of traffic thanks to wheat shipments starting again and the new Government policies that encourage foreign trade.

- A sustained, though not, dramatic rise in the worldwide price of crude.

STS BUNKER AT ZONA COMUN FOR NEXT DAYS:

Will keep you posted.

Best regards,

Antares Servicios Maritimos S.A.

For more information